Traditional banks and newcomers in FinTech are ready to innovate together. Improving the customer experience and reducing friction were the two main themes discussed on June 9 at the Canadian Retail Banking Conference in Toronto. I’ve been invited by RFi Group to talk about innovation, and particularly about how Savoir-faire Linux helps traditional banks transform. In this first instalment of a three-part blog, we’re looking at the environment, the conversations, and the things that may keep people awake at night.

A Wake-Up Call

McKinsey warned that 52% of retail banking revenues might be at risk.

Fortunately for us Canadians, our banking sector remained strong throughout the 2008 crisis. Our risk management approach paid off. We protected capital and we strengthened our reputation as one of the best countries to invest in. At the forefront of banking reinvention, our FinTech sector (which literally leverages technology to innovate) attracted more that $1B since 2010.

Map of the Canadian FinTech sector (OMERS Ventures)

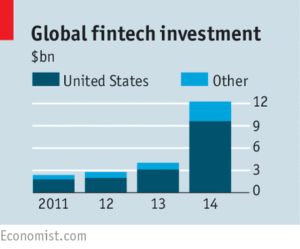

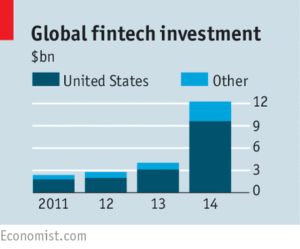

Less fortunately, we don’t seem to feel the same sense of urgency to innovate as other countries.  For example, the US FinTech sector attracted $9B in 2014 alone (75% of world wide investments) according to The Economist (May 9, 2015 -see the figure on the right). Adoption seems to be more rapid in those markets as well. Paypal, Square, the Lending Club are good examples, not to mention Apple Pay and Android Pay. We should be careful that healthy prudence does not turn into a barrier for innovation in Canada.

For example, the US FinTech sector attracted $9B in 2014 alone (75% of world wide investments) according to The Economist (May 9, 2015 -see the figure on the right). Adoption seems to be more rapid in those markets as well. Paypal, Square, the Lending Club are good examples, not to mention Apple Pay and Android Pay. We should be careful that healthy prudence does not turn into a barrier for innovation in Canada.

The Business Case to Innovate

There are two well established areas of disruption everyone is talking about. The first area tackles the barrier to families of foreign workers who are sending cash back home.

The

World Bank estimates that a 5% reduction in remittances prices can save up to $16B per year.

However, services like TransferWise can save at least twice this amount on services otherwise provided by an Oligopoly (including Western Union and Moneygram). Many argue about how many schools and hospitals could be built in Africa with these savings. In 2014, remittances amounted to $582B ($435 of which was sent to developing countries). Mexico amounting for half of remittances may be a future topic of conversation for the three amigos.

The second major area of disruption occurs in the lending space. Following a model similar to Uber, individuals are bypassing banks with Peer-to-Peer lending. The Lending Club is often cited as the most successful IPO, which suddenly positioned the new company as the 14th largest bank in America, valued at $9B. According to Foundation Capital (invested in the Lending Club), the total addressable market (TAM) is about $1T. In the UK alone, the Peer-to-Peer Finance sector raised over $7B (close to $4B last year alone).

The World Bank estimates that crowdfunding could reach $96B per year by 2025 in developing countries. It becomes more interesting when we think that access to capital was a major issue not so long ago. Entrepreneurs around the world are starving for funding to innovate. Also, 2.5B individual still have no credit historial, since they remain unbanked!

The business case is easy to figure out: great margin savings and massive (global) scope. Furthermore, the collective intelligence seems to be more accurate in picking the right investments than fund managers. The rapid increase in FinTech investment is relentless to innovate. What other value can massive collaboration bring to businesses and individuals? How will next generation ventures further leverage the decentralization of the Internet and massive collaboration to disrupt the disruptors? In the next blog post, we’ll look at what banks and new FinTech ventures are developing today.

Thanks for your comment. We’re on it.